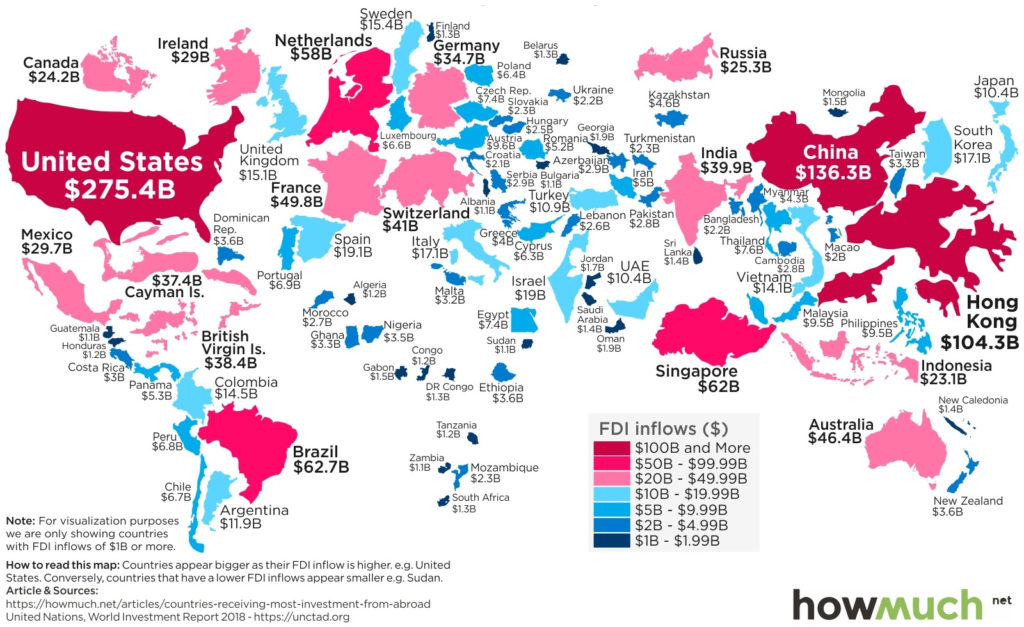

Foreign direct investment (FDI) flows have been on the wane since 2015. That trend only seems to be increasing: in the first half of 2018, global FDI was down 41% compared to the previous year. It’s a worrisome trend with several contributing factors, but one thing is clear: FDI is a critical ingredient for economic growth. Regional development entities would be wise to redouble their investment attraction efforts.

Uncertainty and Isolationism

The change to US tax policy under President Trump has been one of the biggest reasons for the decline in FDI, as US companies were incentivized to repatriate profits in 2018. The US actually had a negative FDI flow for Q1 of that year. However, the US tax regime is perhaps a symptom of the larger issue: creeping isolationism and a retreat from globalization. The American leadership’s stance, Brexit, and US-China trade disputes have put the brakes on corporate investment in foreign markets.

Invest for the Long Term

The benefits of FDI are many, for both mature and developing economies. It is not without risk to either the investor or recipient region, but it is generally accepted that FDI creates new jobs, supports ancillary industries, promotes greater trade, and encourages knowledge-sharing and joint ventures. The US government agrees.

Foreign investment into the UK dropped off significantly in the wake of the 2016 Brexit vote. As the UK retreated, countries like Germany, France

Protectionism and trade friction have thrown geopolitics into choppy waters, but regions that remain committed to welcoming foreign investors and attracting new opportunities are best-positioned to become tomorrow’s innovation hubs.